ERP系统中的机器折旧计算:让财务管理更轻松高效

在现代企业的运营中,固定资产的管理和折旧计算是财务部门不可或缺的重要任务之一。许多中小企业在处理机器设备折旧时常常面临效率低、数据混乱、易出错等问题。传统的手工计算方式不仅费时费力,还容易因为人为疏忽而导致财务数据不准确,甚至影响企业的税务合规性和经营决策。对于一家需要高效管理的企业来说,如何快速、准确地完成机器折旧计算,成为了财务管理中的一个痛点。

Fortunately, with the development of enterprise resource planning (ERP) systems, businesses now have access to advanced tools that automate and streamline the depreciation calculation process. The machine depreciation module within an ERP system is specifically designed to simplify this task, ensuring accuracy, efficiency, and compliance with financial regulations.

什么是机器折旧计算?

Machine depreciation refers to the process of allocating the cost of a machine over its useful life. This is a critical part of financial accounting, as it reflects the decline in the value of the machine over time. In an ERP system, the machine depreciation module is a specialized tool that automates this process, integrating seamlessly with the broader financial management system. It allows businesses to efficiently track, calculate, and report depreciation for all types of machinery, ensuring that financial statements are accurate and up-to-date.

机器折旧计算的功能

The machine depreciation module in an ERP system offers a range of powerful features that make the depreciation calculation process easier and more efficient. These include:

-

自动化计算:The module automatically calculates depreciation based on predefined rules and parameters, eliminating the need for manual calculations. This reduces the risk of errors and saves time.

-

多种折旧方法:The system supports different depreciation methods, such as straight-line, reducing balance, and units of production. This flexibility allows businesses to choose the method that best suits their needs.

-

动态调整参数:Businesses can easily adjust depreciation parameters, such as useful life and salvage value, as needed. This ensures that the calculations remain accurate even as circumstances change.

-

数据集成与同步:The module integrates with other parts of the ERP system, such as the general ledger and fixed asset management. This ensures that all financial data is consistent and up-to-date.

-

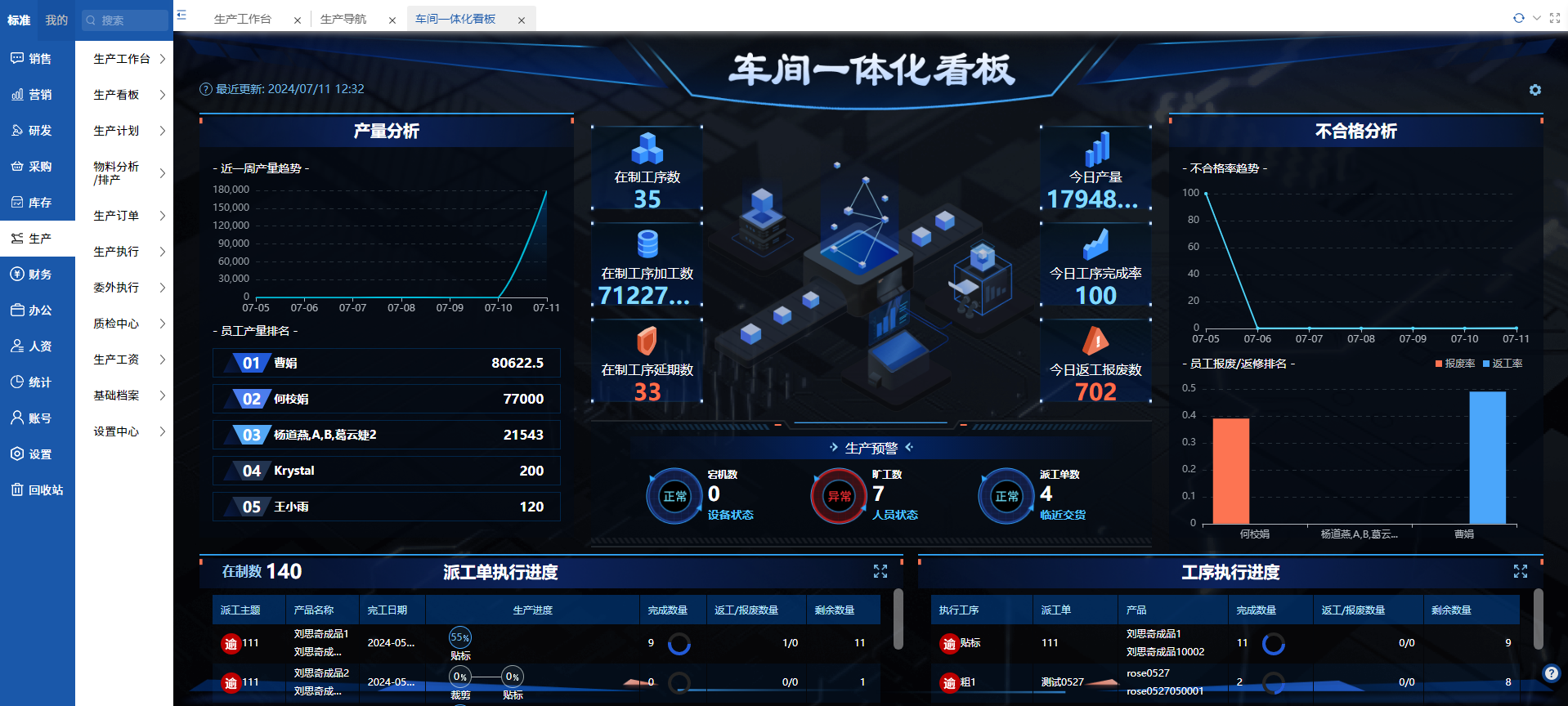

财务报告与分析:The system generates detailed reports and analyses, providing insights into depreciation trends and financial performance. This helps businesses make informed decisions.

-

审计与合规:The module maintains an audit trail of all depreciation calculations, ensuring transparency and compliance with accounting standards. This is particularly important for businesses subject to external audits.

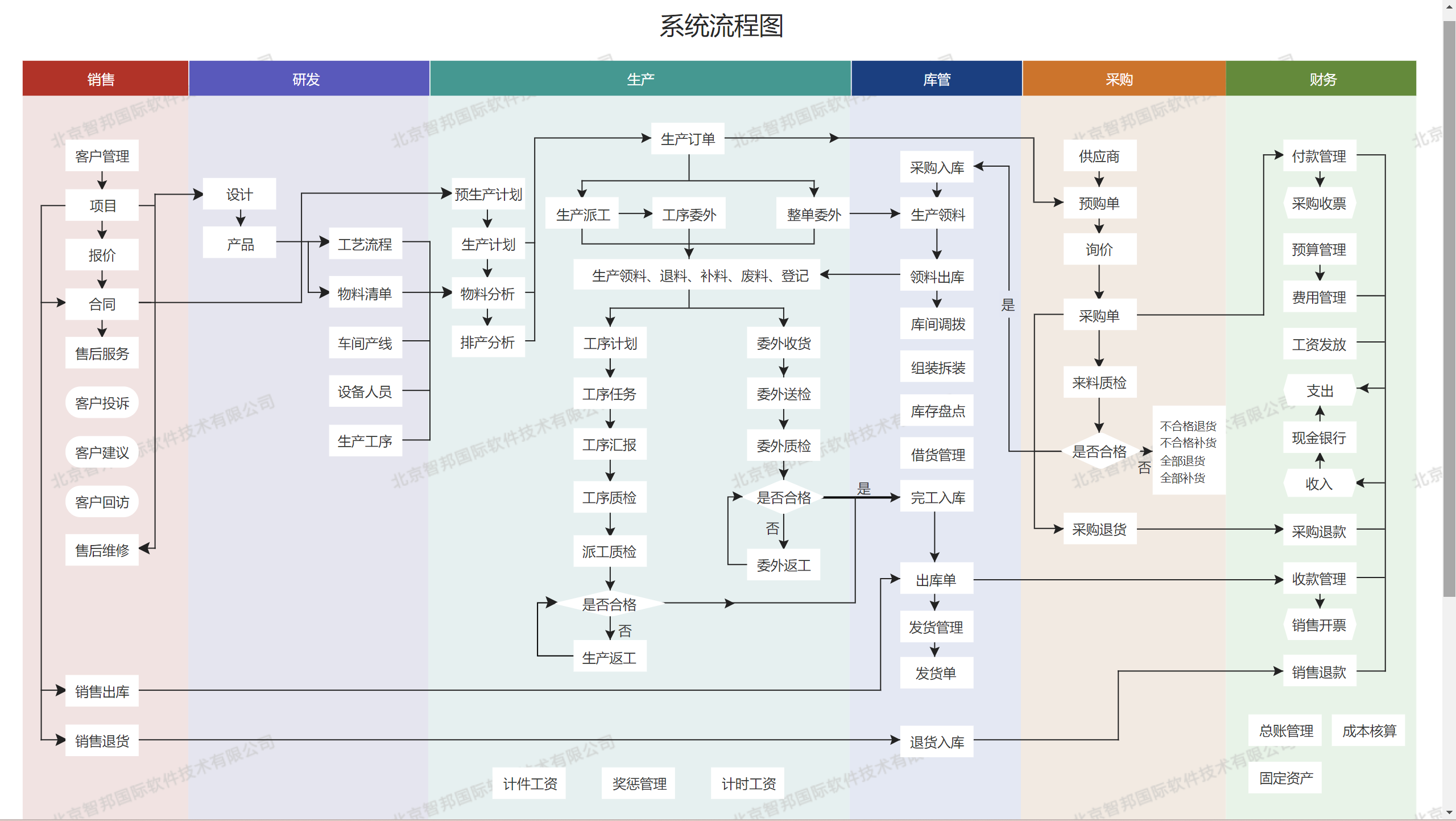

机器折旧计算的业务流程

The process of calculating machine depreciation in an ERP system typically involves the following steps:

-

录入机器信息:The first step is to input the details of the machine, including its cost, useful life, salvage value, and depreciation method. This information is stored in the ERP system's fixed asset module.

-

设置折旧参数:The next step is to set up the depreciation parameters, such as the depreciation method and useful life. These parameters are used by the machine depreciation module to calculate depreciation.

-

系统自动计算:Once the parameters are set, the ERP system automatically calculates the depreciation for each machine. This is done on a monthly or annual basis, depending on the system's configuration.

-

审核与调整:The calculated depreciation is then reviewed and adjusted by the finance team if necessary. This ensures that the calculations are accurate and comply with financial regulations.

-

生成财务报表:The depreciation data is then used to generate financial statements, such as the profit and loss statement and the balance sheet. This provides a clear picture of the company's financial performance.

-

存档与审计:Finally, the depreciation calculations and related documentation are archived for future reference. This is important for internal and external audits.

机器折旧计算对中小企业的意义

For small and medium-sized enterprises (SMEs), the machine depreciation module in an ERP system offers numerous benefits that can significantly enhance financial management. Here are some of the key advantages:

-

提高效率:Manual depreciation calculations are time-consuming and prone to errors. By automating the process, SMEs can save valuable time and reduce the risk of errors.

-

提高准确性:The machine depreciation module ensures that depreciation calculations are accurate and consistent. This helps businesses avoid financial discrepancies and stay compliant with accounting standards.

-

减少人为错误:Human error is a common issue in manual calculations. By automating the process, SMEs can minimize the risk of mistakes, ensuring that financial data is reliable.

-

增强合规性:The module maintains an audit trail of all depreciation calculations, ensuring transparency and compliance with financial regulations. This is particularly important for SMEs that are subject to external audits.

-

支持决策:The detailed reports and analyses provided by the module give SMEs valuable insights into their financial performance. This helps business owners make informed decisions about their operations and strategy.

-

** scalability **:As SMEs grow, their financial management needs become more complex. The machine depreciation module in an ERP system is designed to scale with the business, accommodating the increasing number of machines and more complex depreciation requirements.

结语

In conclusion, the machine depreciation module in an ERP system is a powerful tool that can transform the way SMEs manage their financial affairs. By automating the depreciation calculation process, integrating with other financial modules, and providing valuable insights, the module helps businesses improve efficiency, accuracy, and compliance. For any SME looking to streamline its financial operations and achieve long-term success, implementing an ERP system with a robust machine depreciation module is a smart move.

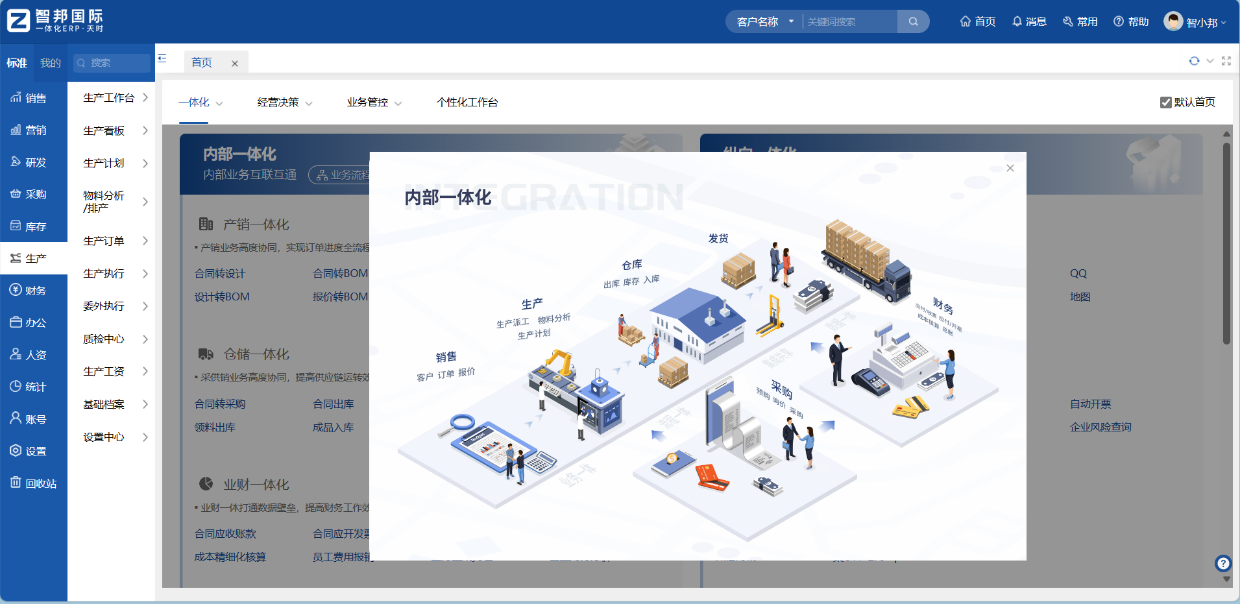

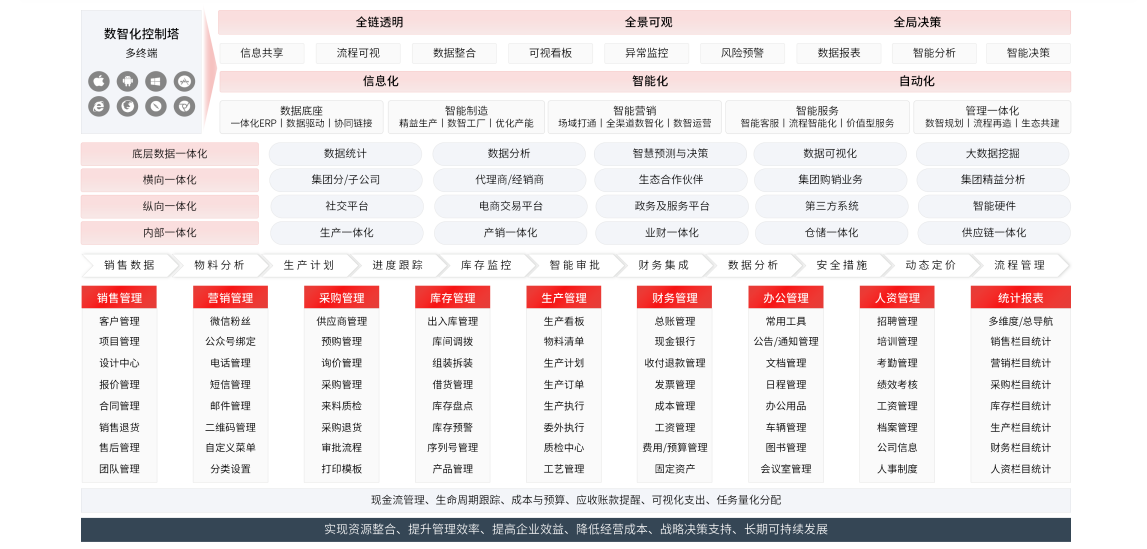

欢迎咨询试用智邦国际一体化ERP软件!点击右边“在线咨询”或“免费试用”按钮,稍后售前ERP软件顾问会联系到您,为您讲解、试用、演示软件使用效果,以及发送产品资料和商务报价~(解决:生产管理、财务、仓库、采购、销售、项目、客户、集团管理等等)